Hi, I'm Richard

a first year at

University of Waterloo

studying Computing + Financial Management

(CS+Finance)

Projects

Robo Advisor

A pipeline built in python that inputs a list of tickers, and filters them based on trading volumes, currencies, and valid listing.

Uses statistics like Alpha, Beta, and Sharpe Ratios to pick optimal stocks

Builds an optimal portfolio, starting with $1 million CAD initial investment, based on optimal returns over the S&P 500 index

Achieved a +1.70% return over the S&P 500 index in December 2025 Alone

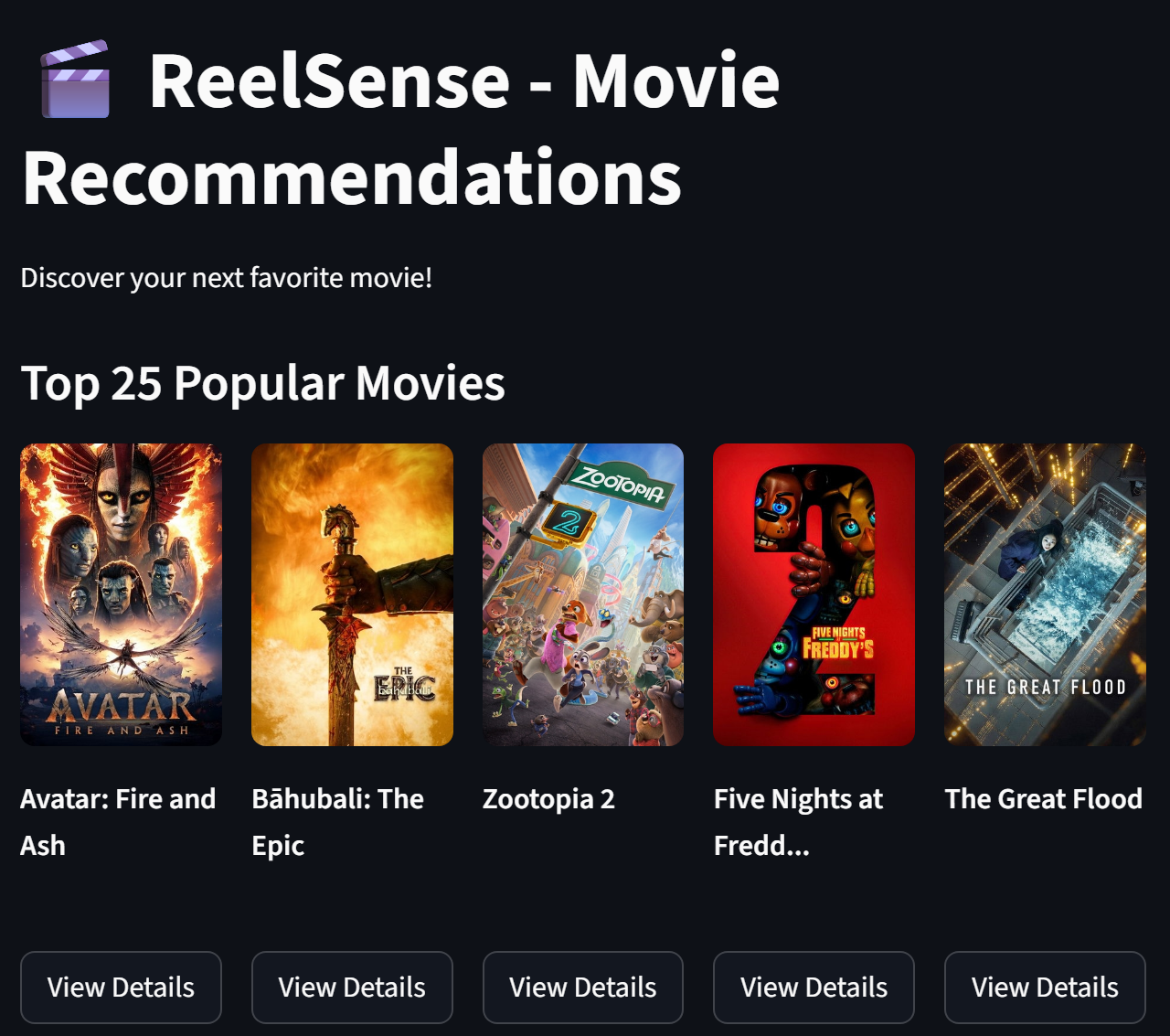

ReelSense (In Development)

A movie recommender system that uses TFIDF vectorization and cosine similarity to recommend movies based on plot descriptions.

Uses TMDB API to fetch movie data and display posters in a dynamic, interactive UI built with Streamlit.

Users can search a movie and find similar movies, as well as find similar movies to all previously liked movies

MeRich Stock Analyzer (W.I.P)

A Flask application built to visualize a stock of the user's choosing

Reflects the stock performance, its metrics (volatility/risk, Alpha, Beta, Sharpe Ratio, financial ratios, etc.)

Grades the current stock out of 10 based on its metrics and how well it's doing.

Provides a Buyer Analysis based off the rating out of 10, as well as professional buyer analysis.

Experience

Peer Tutor

Toronto District School Board

(November 2022 -- June 2025)

Tutored high school in students like Math (Including AP), Science, and Computer Science

Helped students develop projects and debug projects in Computer Science, and understand content in all classes

Developed communication and interpersonal skills by working with a diverse range of students and learning styles

Improved grade averages of students tutored, some from 70s to mid 80s.

Software + Game Developer

No Fuss Tutors

(June 2024 -- September 2024)

Worked as a software and game developer for a tutoring startup

Used React, TypeScript, Konva.js, Git, and Github to develop an interactive web-based educational dashboard

Worked on game-based learning modules to help students learn math and language concepts through interactive games

Used by hundreds of students to assist with elementary-level learning